Exceptional features to

enrich your experiences

No Joining & Annual fee

Offers on Entertainment

Fly in Style

Exclusive Privileges

FAQs

FAQs

What is the lowest Credit Card limit?

The Credit Card limit varies depending on the Card issuer.

How do I see my Credit Card number online?

You can find your ICICI Bank Credit Card number by logging into Internet Banking or the iMobile app.

How can I redeem Credit Card points for rewards?

You can enjoy seamless redemption of Rewards with ICICI Bank. Log into ICICI Bank Internet Banking or the iMobile app and navigate to the Rewards section. Here, you can redeem your ICICI Bank Rewards across multiple categories such as electronics, lifestyle, luxury, shopping and travel.

How do I avail the BookMyShow offer?

Follow these steps to avail the BookMyShow offer:

- Select the movie you want to watch

- Go to ‘Book Tickets’

- Select the location and time

- Select the number of seats and proceed

- Go to ‘Pay’ and accept the T&Cs

- Click on ‘Unlock Offers’ or ‘Apply Promo Codes’

- Choose ‘Credit Cards’ option

- Type ‘ICICI’ in the search bar and select your offer (e.g. Up to ₹500/- off or 25% off up to ₹100/- on 2nd ticket)

- Enter your full Credit Card number

- The offer will be applied, then proceed with payment.

What are the ways to activate credit card?

Credit card can be activated in multiple ways. However, the easiest way is to do a minimum of one transaction on the card.

Other ways:

- Minimum one transaction has been done on the card (1 to 37 Day)

- Pin generation

- Card controls change

- Limit change

- Add-on application

- Billing date change

- Tokenization – Amazon

- UPI ID creation (In case of Rupay card)

-

Via missed Call registration → 75730 60605

Give a missed call on 7573060605 from your registered mobile number. -

Via SMS short code: Message → CCUSG To → 5676766

Activate ICICI Bank Credit Card {"{#XX1234#}"} by {"{#DD-Mon-YY#}"} to avoid closure as per regulatory guidelines. To retain, WhatsApp at {"{#icici.co/DUvfENLmOnt#}"} / SMS {"{#CCUSG#}"} to {"{#5676766#}"} / give a missed call on {"{#7573060605#}"} from registered mob no. -

Via IVR Calling → This is Bank Initiated

"Dear Customer, this is an important call from ICICI bank regarding your newly issued credit card ending with 'XXXX'. As per the RBI guidelines, this card needs to be activated within 30 days of card issuance, failing which the card will get cancelled. To keep your Card active please Press 1"

In case of no input 1st time:

"Please press 1 to keep your card active else it would get cancelled".

What is the discount offered on IXIGO for new credit card customers?

Customers get a flat ₹1,200/- instant discount with no minimum booking value required, just you need to activate your new card within 30 days.

Where can I use this IXIGO offer?

The offer is valid on domestic and international flights as well as hotels booked via IXIGO.

How long is the voucher code valid after it is issued?

The voucher is valid for 5 months from the date of email received by customer.

How many times can I use the IXIGO voucher code?

Each voucher code can be used only once per customer per application. (P.N. In case of dual card only one set of Voucher will be received)

Is there any condition under which the offer might change?

IXIGO may review the offer's performance after six months and could change the offer structure if needed to restrict the burn.

Does the IXIGO discount apply if I book a round-trip or multi-city itinerary, or only on one-way bookings?

The instant discount applies to all types of eligible bookings, including one-way, round-trip, and multi-city trips, if it’s booked via IXIGO.

Can I use the IXIGO offer for bookings that include international hotels or only within India?

The offer specifically covers both domestic and international flights and hotels.

Are there blackout dates or peak times (like festivals) when the IXIGO offer cannot be applied?

Unless stated otherwise, the voucher is applicable for bookings during all periods, subject to availability and specific partner restrictions.

If I cancel my booking after applying the voucher, will I get the voucher back or a partial refund?

Since the voucher is single-use and instant, cancelled bookings may forfeit the offer. Refunds will not include the value of the voucher.

Can I combine multiple vouchers or offers on a single IXIGO booking?

Only one voucher code can be applied per customer per booking; combining multiple promos for the same booking is not allowed.

What is the discount offered on purchases at Reliance Digital for new credit card customers?

New credit card customers get a flat ₹500 instant discount on a minimum order value (MOV) of ₹7,000 on all products, including Apple and One Plus. There is also a flat ₹1,000 instant discount on MOV of ₹20,000 on all products except Apple and One Plus, just you need to activate your new card within 30 days.

Can I use this offer on top of existing store and card offers at Reliance Digital?

Yes, the discount is valid over and above store discounts and existing card offers.

How long is the voucher code valid for after issuance?

The offer/voucher is valid for 2 months from the date of email received by customer.

How many times can I use the voucher code?

Each voucher code can be used only once per customer per application. (P.N. In case of dual card only one set of Voucher will be received)

How long does the overall offer arrangement last?

The overall offer arrangement is valid for one year from the start date.

Can I combine my Reliance Digital voucher with multiple transactions, or does the entire discount need to be applied to one purchase?

The voucher must be used in a single transaction; it cannot be split across multiple purchases.

Are accessories and add-ons (like warranties or cables) included in the offer for eligible products?

Yes, all products including accessories are included, except for exclusions mentioned (for the ₹1,000/- offer, Apple and One Plus are excluded).

If I return or exchange my purchase, will I get a new voucher code or is the original offer voided?

In most cases, the voucher code is single-use. Returns may not make you eligible for a replacement code. Please check Reliance Digital’s support for specific scenarios.

Can the voucher be transferred to a friend or family member if I choose not to use it?

Voucher codes are issued for each new customer and are generally non-transferable as they are linked to your credit card and profile.

Are there any online-exclusive or in-store-exclusive products where this offer cannot be redeemed?

The offer can be redeemed both online and in-store across all eligible products, unless specifically excluded in terms and conditions.

What are the advantages of using a Credit Card?

The three main advantages of using a Credit Card are additional benefits through Reward Points, increased spending power, and building a credit history.

What are the reward redemption options under the Hand-picked Rewards programme?

The Hand-picked Rewards catalogue offers a wide range of options from brands across apparel, accessories, books, dining, and more. Gift vouchers are also available, giving you the flexibility to use rewards as you choose.

What are the benefits provided by ICICI Bank credit card?

ICICI Bank Credit Cards offer a range of benefits, including:

- Lifestyle benefits – discounts on shopping, dining & movies, complimentary round of golf every month.

- Travel benefits – fuel surcharge waiver, fuel discounts.

- Other benefits – cash rewards, offers, 24×7 concierge service and more.

Why has my credit card application been rejected?

Your application is evaluated based on parameters like income, credit history, and repayment track record of existing loans and cards.

I want to convert a transaction into EMI. What are the EMI tenure options available?

All retail Credit Card transactions of ₹1,500/- and above can be converted into EMI within 30 days from purchase date, for tenures of 3, 6, 9, 12, 18 & 24 EMIs. Cash, jewellery and fuel purchases are excluded.

How can I earn points quickly?

- Use your ICICI Bank Credit Card daily for groceries, dining, online shopping.

- Enroll in automatic payments for utilities.

- Use it for high-value purchases like travel and jewellery.

- Use the card internationally.

- Gift up to two supplementary cards to family members 18+, and earn points on those too.

I have transferred points to airline frequent flyer account but can’t get booking. Can I transfer them back?

No. Point transfers to airline frequent flyer programs are irreversible.

How can I view my reward points summary?

You can view reward points summary via:

- iMobile app: Pre-approved Loans/Offers > Rewards OR Cards & Forex > Select your card > View in Latest Bill Section

- Net Banking: Cards & Loans > Credit Cards > Reward Points

Is there a limit on free movie ticket price on BookMyShow?

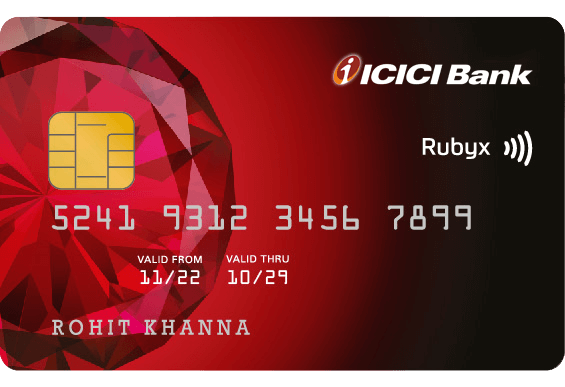

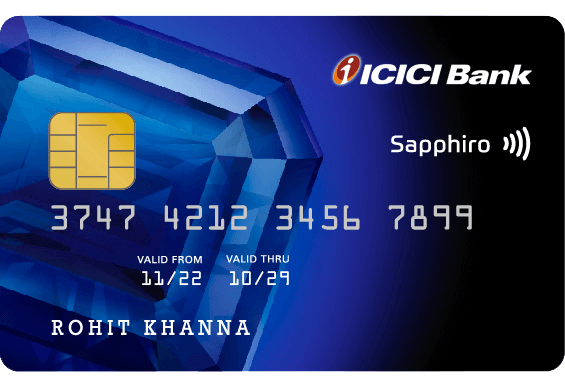

Buy 1 Get 1: Free ticket cannot exceed ₹500/- on Sapphiro, Signature & InterMiles Sapphiro cards.

25% off up to ₹150/-: on a second ticket (min. 2 tickets), up to twice a month on Rubyx, MakeMyTrip Signature, Ferrari Signature, InterMiles Rubyx, Man Utd Signature.

25% off up to ₹100/-: on Coral, InterMiles Coral, Ferrari Platinum, MakeMyTrip Platinum, Man Utd Platinum.

No cap: Diamant Credit Card.

What is a Concierge Medical / Travel / Emergency Service?

A concierge service is a special service designed to assist with personal or professional tasks, acting like your own personal assistant.

What services can concierge help me with?

We offer a range of services based on the Credit Card you hold. Please refer to your card page for specific details.

How much do you charge for Concierge Travel / Medical / Emergency?

Concierge is complimentary for ICICI Bank Credit Card members. You only pay for any bookings or purchases you make through the service.

Where to check the offers available on credit card?

Check offers by visiting ICICI Bank’s website under Products > Credit Cards > Know More.

What are the minimum ICICI Bank Rewards needed to start redeeming?

There is no minimum number of reward points required to begin redeeming.

What documents are required for an add-on card request?

Submit the Supplementary Card form with separate identity and address proofs of the add-on card holder, such as Passport, Voter ID, Driving License, PAN, Ration Card, or utility bills.

How many times can I change the present limit on card?

There is no cap on changing your preset limit. The preset limit reset functions according to the calendar month.

Can you deliver the credit card to my family while I’m traveling?

The card will only be delivered to the primary cardholder unless you provide an authorization letter permitting delivery to parents, spouse, adult children, grandparents, or siblings above 18, and they present valid ID at the time of delivery.

What is the validity of credit card OTP/security code?

For online transactions, the OTP is valid for 15 minutes. If it expires, please request a new one.

Can I apply for Add-on card for my spouse?

Yes, you can apply for up to 3 supplementary cards at no extra charge. Submit a form with identity and address proofs of your spouse.

How many Add-on credit cards can I apply for?

You can apply for a maximum of 3 add-on cards against one primary credit card.

Which ICICI Bank Credit Card offers fuel savings?

Fuel Saver Cards include HPCL Coral AmEx, HPCL Coral Visa/MasterCard, and HPCL Super Saver Credit Cards.

*available on selected cards

*available on selected cards